dupage county sales tax rate 2020

DuPage County collects on average 171 of a propertys assessed fair market value as property tax. 2020 rates included for use while preparing your income tax deduction.

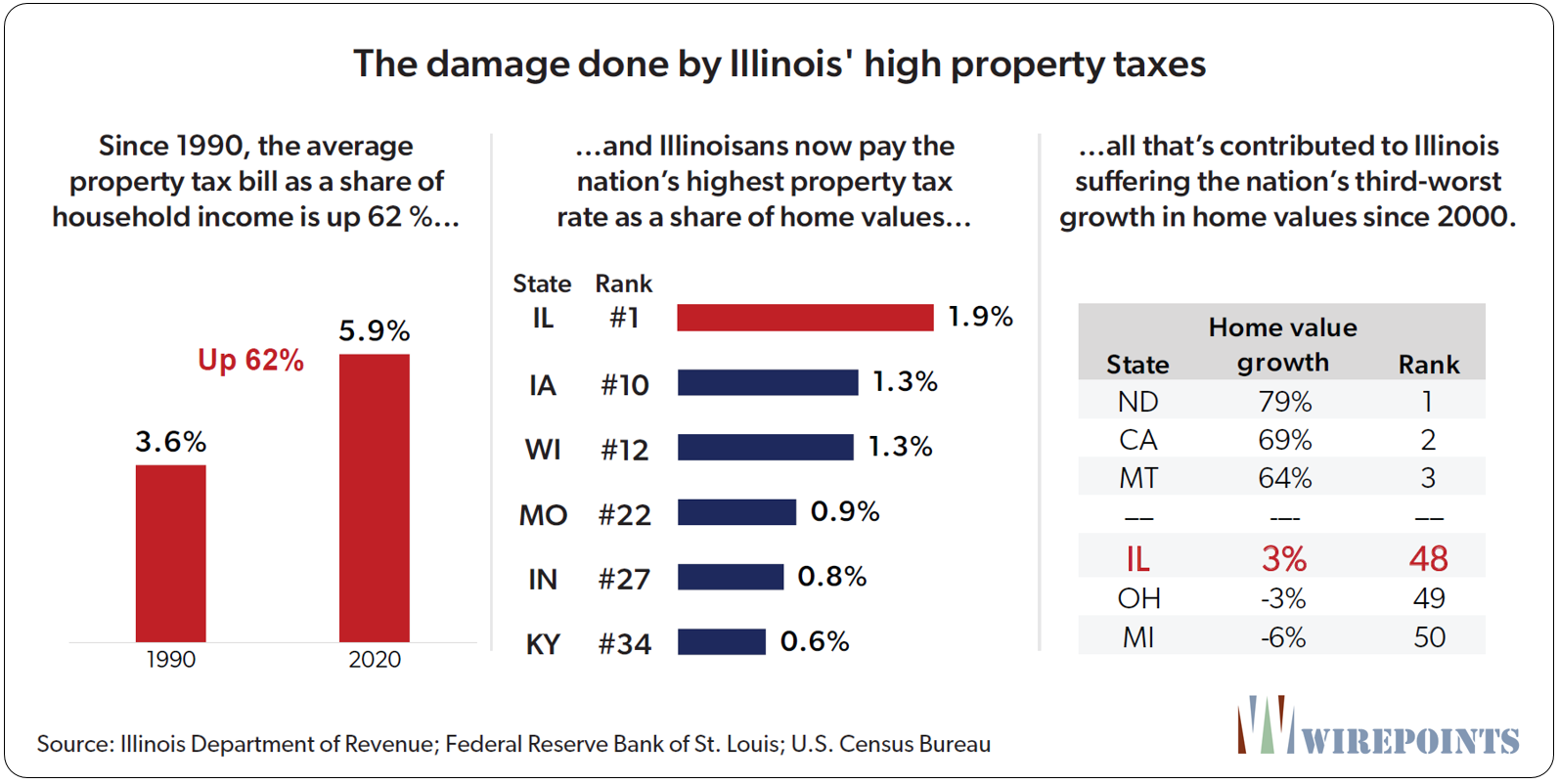

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Property Tax Rate and Extension Reports.

. This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax deduction. Our website is available 247 as is our online payment program.

IL Rates Calculator Table. 2020 rates included for use while preparing your income tax deduction. The tax levies are adopted by each taxing districts board and the Equalized Assessed Value of the properties in each district is certified by the Supervisor of Assessments.

The minimum combined 2022 sales tax rate for Dupage County Illinois is. The base sales tax rate in dupage county is 7 7 cents per 100. The latest sales tax rate for DuPage County IL.

Higher maximum sales tax than 97 of Illinois counties. Beginning May 2 2022 through September 30 2022 payments may also be mailed to. This includes a full list of taxing districts in the county with their tax rates.

As of May 20 Dupage County IL shows 4576 tax liens. Naperville IL Sales Tax Rate. The Illinois sales tax of 625 applies countywide.

This rate includes any state county city and local sales taxes. Majestic Life Church Service Times. 2020 rates included for use while preparing your income tax deduction.

The December 2020 total local sales tax rate was also 7000. Beginning May 2 2022 through September 30 2022 payments may also be mailed to. DuPage County has one of the highest median property taxes in the United States and is ranked 27th of the 3143 counties in order of median property taxes.

2 State Sales tax is 625. Income Tax Rate Indonesia. Dupage County Sales Tax Rate 2020.

Box 4203 Carol Stream IL 60197-4203. This rate includes any state county city and local sales taxes. Dupage county sales tax rate 2020 Tuesday March 15 2022 Edit.

The DuPage County Clerks Office calculates the tax rates set within statutory limits for every taxing district in DuPage County. Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types in our state. 2020 rates included for use while preparing your income tax deduction.

IL Rates Calculator Table. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425. Illinois has state sales tax of 625.

You need to be more concerned about where your working and what the commute will be like. 2020 DuPage County Tax Rate Booklet. IL Rates Calculator Table.

The base sales tax rate in DuPage County is 7 7 cents per 100. The latest sales tax rate for Darien IL. Tax allocation breakdown of the 7 percent sales tax rate on General.

Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. Heres how Dupage Countys maximum sales tax rate of 105 compares to other counties around the United States. After the sale the property owner has up to 25 years to redeem the property and keep the home.

The Dupage County sales tax rate is. This rate includes any state county city and local sales taxes. The base sales tax rate in DuPage County is 7 7 cents per 100.

Kerrins 7314 Sunrise Avenue Darien IL 60561 Find homes for sale market statistics foreclosures property taxes real estate news agent reviews condos. Soldier For Life Fort Campbell. IL Rates Calculator Table.

Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate in Cook County is 8 not including any city or special district taxes. You have up to the day immediately before the sale to pay all delinquent taxes and other costs to stop the sale. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N.

Opry Mills Breakfast Restaurants. The base sales tax rate in dupage county is 7 7 cents per 100. The current total local sales.

Restaurants In Matthews Nc That Deliver. Our website allows you to print a duplicate tax bill pay your bill see assessment information view 5 years of property tax history and 5 years of sale history. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425.

Box 4203 Carol Stream IL 60197-4203. This rate includes any state county city and local sales taxes. If your Property Taxes are Sold at the Annual Tax Sale Held on November 1718 2022.

2020 rates included for use while preparing your income tax deduction. Essex Ct Pizza Restaurants. DuPage County has one of the highest median property taxes in the United States and is ranked 27th of the 3143 counties in order.

82500. Elmhurst Details Elmhurst IL is in DuPage County. Downers Grove IL Sales Tax Rate.

Interested in a tax lien in. The 2018 United States Supreme Court decision in South Dakota v. The current total local sales.

This rate includes any state county city and local sales taxes. Elmhurst IL Sales Tax Rate. 2020 Tax Year County Sales PDF 421 N.

2020 rates included for use while preparing your income tax deduction. The Illinois state sales tax rate is currently. DuPage County IL Government Website with information about County Board officials.

What is the sales tax rate in Dupage County. County Farm Road Wheaton IL 60187 630-407-6500. The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900.

County Farm Road Wheaton IL 60187. DuPage County Collector PO. The current total local sales.

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

What Is Illinois Sales Tax Discover The Illinois Sales Tax Rates For 102 Counties

Illinois Car Sales Tax Countryside Autobarn Volkswagen

/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg)

How To Pay Your Property Tax Bill

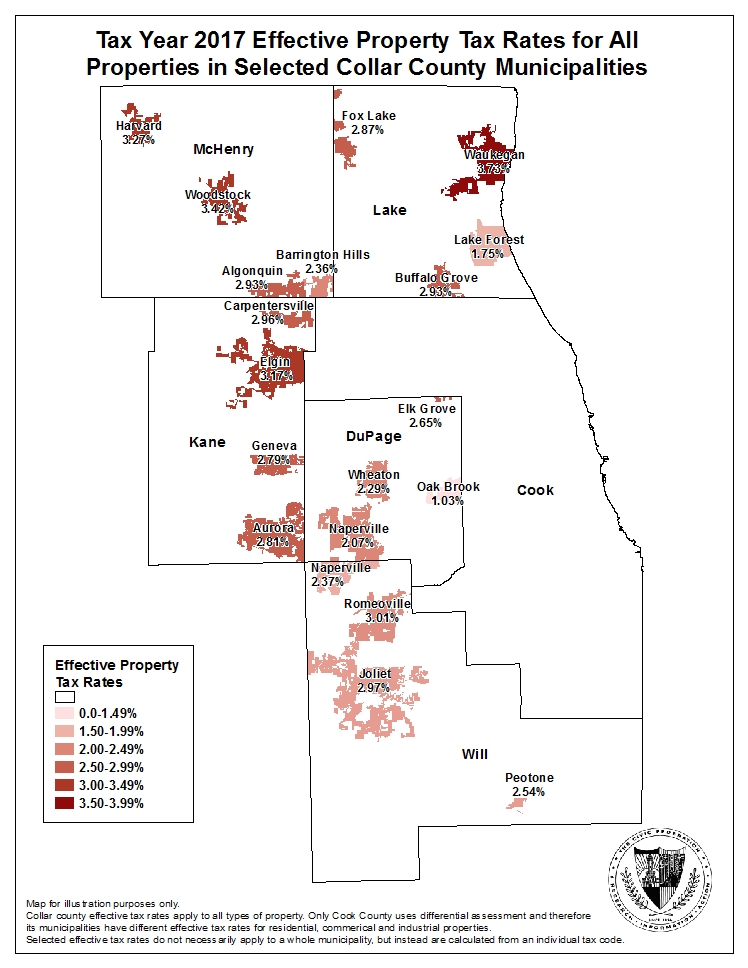

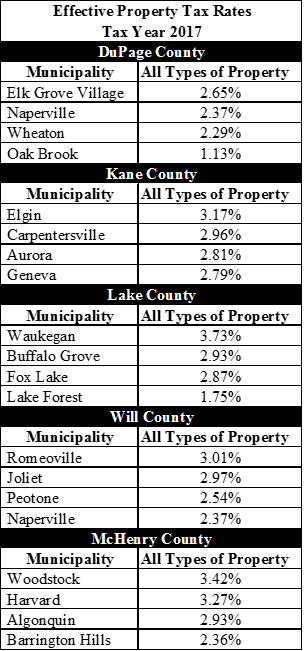

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

North Central Illinois Economic Development Corporation Property Taxes

Illinois Sales Use Tax Guide Avalara

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

California S Highest In The Nation Gas And Diesel Taxes California Globe

How To Calculate Cannabis Taxes At Your Dispensary

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Illinois Sales Tax Rates By City County 2022

How To Calculate Cannabis Taxes At Your Dispensary

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

What Is Illinois Car Sales Tax